Softship.Finance controls all operating expenses and revenues and ensures that voyage profitability is actively managed. Invoices from Freight, Demurrage/Detention and miscellaneous charges are created based on agreed rates and will ensure that invoices are accurate when they go out to clients.

Your agreed supplier tariffs are stored in Finance. With data extracted from the manifest and Statement of Facts, estimates are automatically created. Supplier invoices are reconciled against these estimates and, when approved, are posted against the voyage accounts and interfaced with your accounting/ERP system.

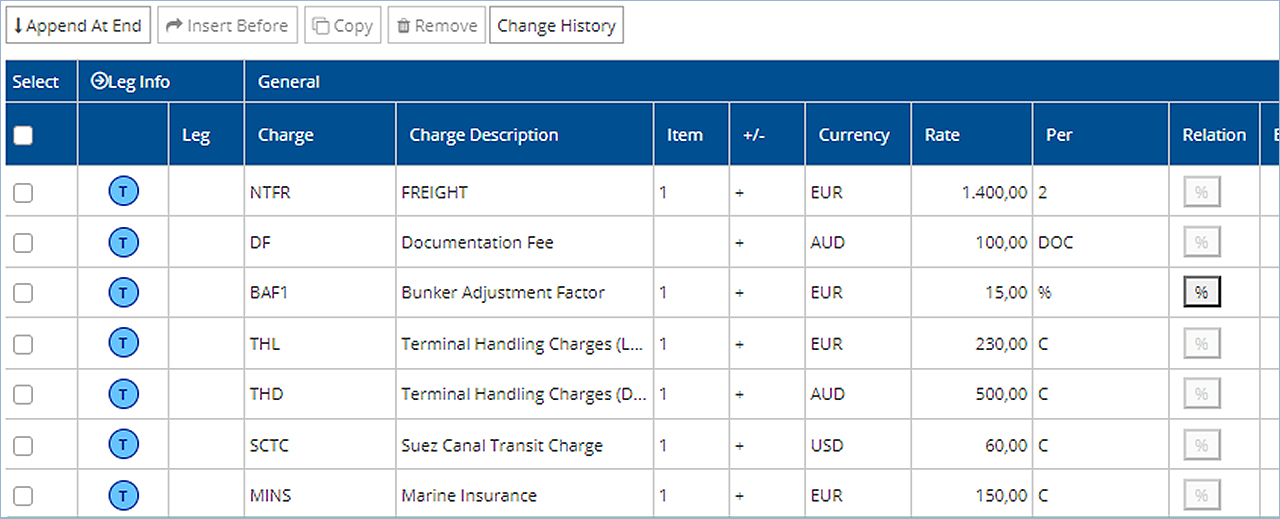

All standard/open tariffs are stored in this central repository. This includes all the rates for freight tariffs as well as surcharges. Sales tariff data is used by the automated rating engine during the contract, quotation or booking processes to ensure that all applicable rates and charges are considered and correctly applied.

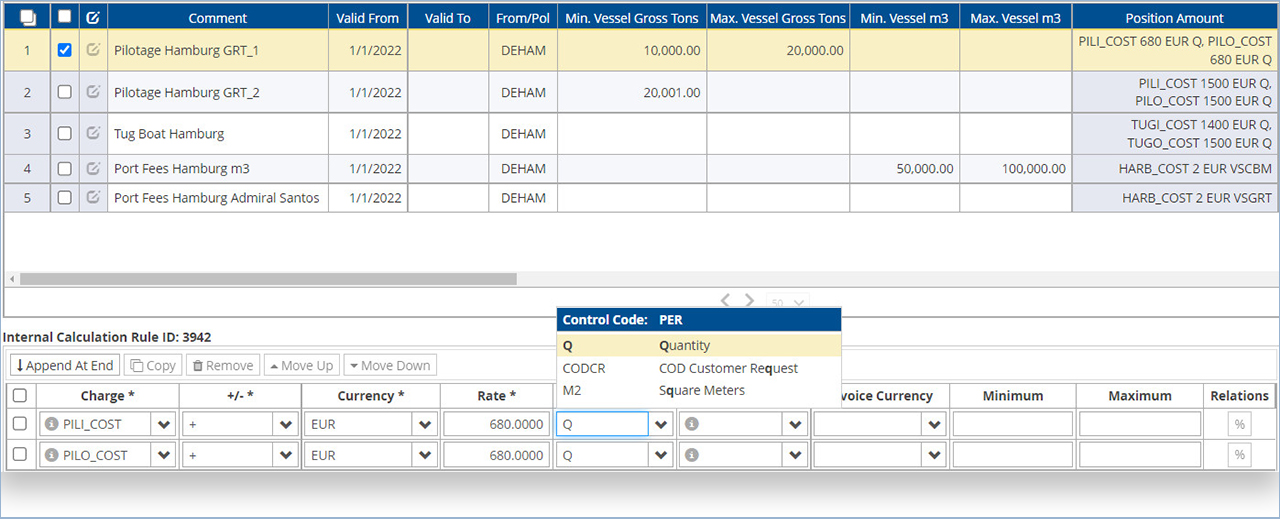

Any supplier agreement related to cargo, vessel or port costs is stored in this repository. Supplier agreements of any complexity can be managed in here and are used to calculate the yield of each transport option and to create cost estimates for supplier invoice reconciliation.

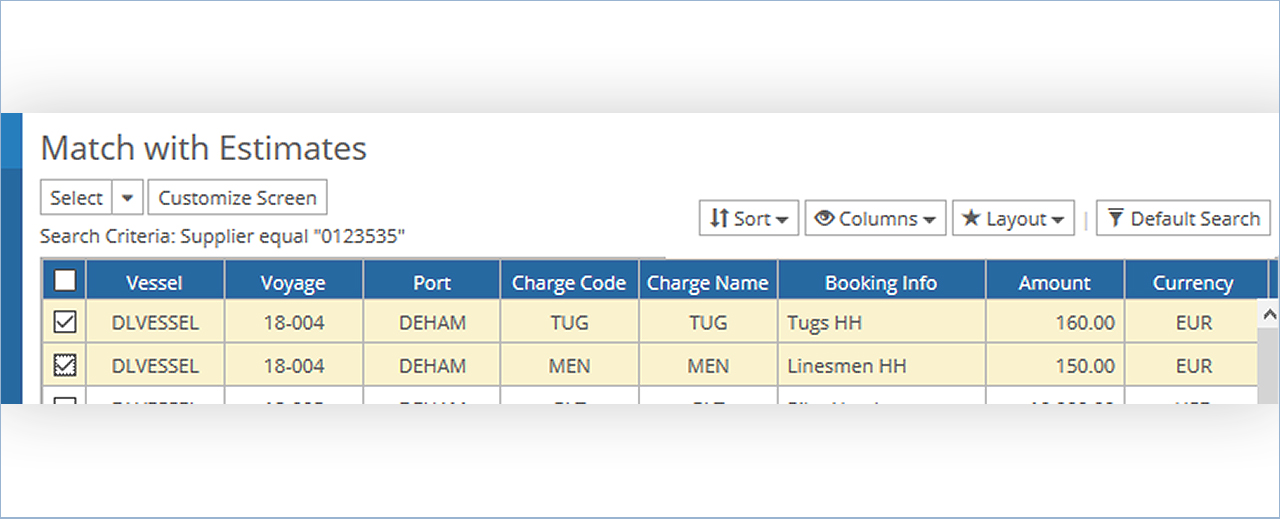

Based on system transactions, the software automatically matches supplier invoices with related estimates (purchase orders). This allows speedy approval of consistent transactions and frees resource to focus on exception and dispute management.

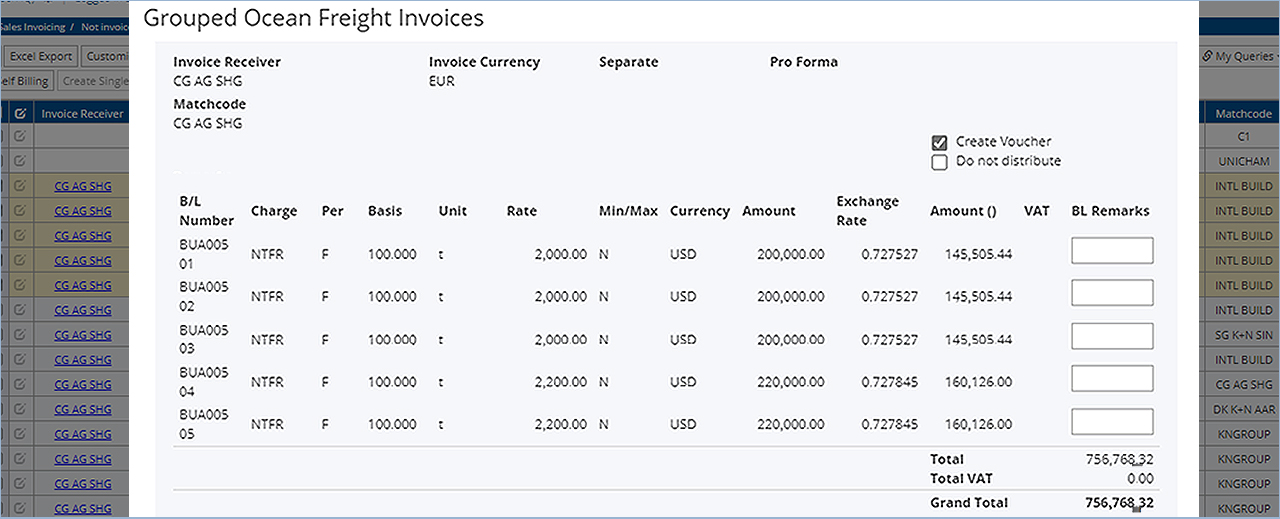

Auto-Billing processes can be configured based on each customer’s needs. Automation of standard or recurring invoice processes helps you to meet invoice accuracy benchmarks so your focus can be shifted to handling exceptions.

By treating agents like suppliers, the traditional disbursement accounts process becomes obsolete as the statement can be sent to the agent automatically upon vessel sailing and completion of the Statement of Facts, thus increasing cash flow and reducing errors.

Softship.Finance vouchers can be interfaced with your Accounting/ERP system to process accounts receivable invoices, payment vouchers and accounts payable invoices, for complete control and transparency.